February 13, 2019

Weakness concentrated in the West

In January the Teranet–National Bank National Composite House Price IndexTM was down 0.1% from the previous month.[1] It was the fifth consecutive month without a rise, the longest such run since March 2013, and was notable for marked retreats in the three largest markets of Western Canada: Edmonton (−0.8%), Calgary (−0.5%) and Vancouver (−0.3%). The index for Ottawa-Gatineau was also down (−0.3%). Indexes for Victoria and Hamilton were flat. There were monthly rises for Quebec City (+1.3%), Halifax (+0.7%), Montreal (+0.2%), Toronto (+0.1%) and Winnipeg (+0.1%).

Those three westernmost markets have been trending down markedly for months now. For Calgary it was a seventh month without a gain (cumulative decline -2.4%), for Vancouver the sixth (−3.2%), for Edmonton the fifth (−3.5%). There were smaller cumulative declines, after four months with no rises, in Victoria (−0.5%) and Hamilton (−1.0%). For Montreal, on the other hand, the index was up for the ninth time in 10 months for a cumulative 5.0% gain. Montreal and Quebec City were the only indexes at an all-time high in January.

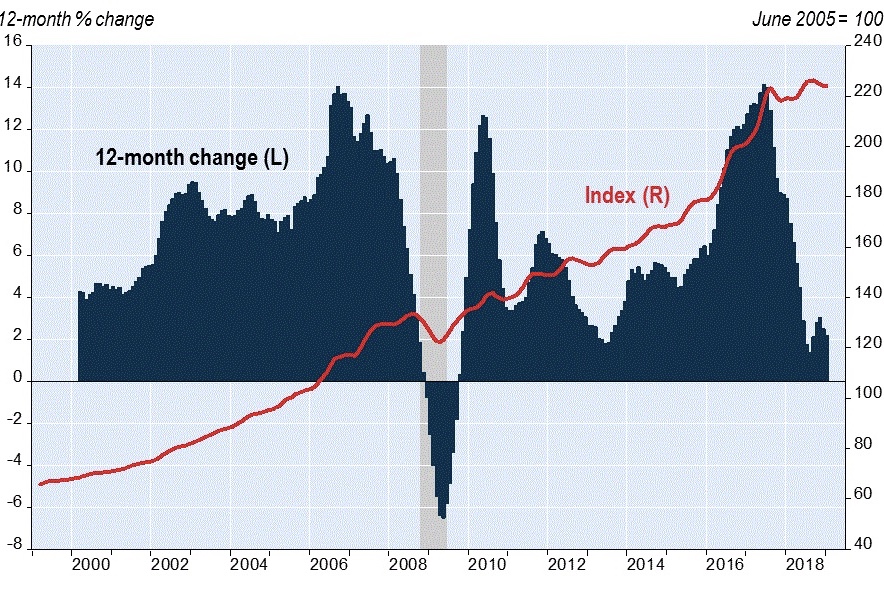

Teranet-National Bank National Composite House Price Index™

The softness of the three largest markets of the West was also apparent in the changes from a year earlier –Calgary down 2.8%, Edmonton down 2.4%, Vancouver flat. The eight other markets in the composite index were up from a year earlier – Winnipeg 0.7%, Halifax 1.7%, Quebec City 3.1%, Toronto 3.6%, Montreal 4.5%, Hamilton 4.6%, Victoria 4.9%, Ottawa-Gatineau 6.0%. For the composite index the 12-month rise was 2.2%.

Besides the Toronto and Hamilton indexes included in the composite index, indexes exist for the seven other urban areas of the Golden Horseshoe. In January, they were up from the previous month for Peterborough (0.7%), Brantford (0.4%), Oshawa (0.1%) and Kitchener (0.1%), flat for Barrie, and down for Guelph (−0.2%) and St. Catharines (−0.6%). From August 2018, all seven indexes were down or at best flat: Peterborough −4.1%, Brantford −3.6%, Barrie −2.1%, Oshawa −2.0%, Guelph −1.3%, Kitchener −0.2%, St. Catharines flat.

Indexes not included in the composite index also exist for seven markets outside the Golden Horseshoe, five of them in Ontario and two in B.C. In January, indexes declined for Abbotsford-Mission (−0.2%), Thunder Bay (−0.3%), Windsor (−0.4%) and Kelowna (−1.3%) and rose for London (0.3%), Sudbury (1.0%) and Kingston (1.8%). From last August, indexes were down for Abbotsford-Mission (−1.9%), Kelowna (−3.2%) and Thunder Bay (−5,6 %), essentially flat for Sudbury, and up for London (+2.3%), Windsor (+2.5%) and Kingston (+2.6%).

For the full report including historical data, please visit https://housepriceindex.ca/2019/02/january2019/.