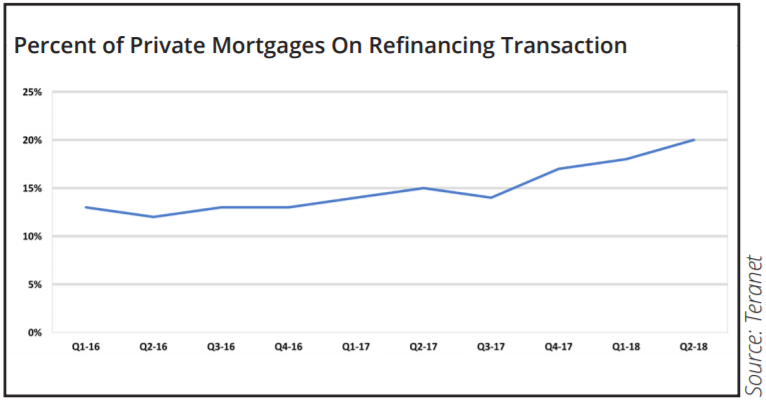

20% of refinancing mortgage transactions (defined as mortgages registered on a property that did not involve a sale) during the second quarter of 2018 were sourced from private lenders – a 67% increase over two years ago.

In Canada, private lenders often serve as the lender of last resort that buyers and owners can turn to when traditional banks and credit unions have turned them down. Private lenders are more willing to take on riskier financing arrangements than traditional lenders and in return charge borrowers much higher interest rates.

When looking at the number of refinancing mortgages registered on a property that have been arranged since 2016, we see that the share financed by private lenders has increased significantly, from a low of 12% during the second quarter of 2016 to 20% during the second quarter of 2018.

Want to learn more about the current state of the Canadian mortgage lending market? Download the October 2018 Teranet Market Insights Report: https://www.teranet.ca/wp-content/uploads/2018/10/Market-Insight-Report_Oct-2.pdf