March 13, 2019

Largest retreat for a February outside of recession

In February the Teranet–National Bank National Composite House Price IndexTM was down 0.4% from the previous month.[1] Except for the recession year of 2009, it was the largest February decline in 19 years of index history. Indexes lost ground in nine of the 11 metropolitan markets of the composite index: Victoria (−2.0%), Hamilton (−1.4%), Quebec City (−1.2%), Calgary (−0.8%), Vancouver (−0.7%), Ottawa-Gatineau (−0.7%), Winnipeg (−0.4%), Toronto (−0.2%) and Edmonton (−0.1%). The only indexes up from the month before were those for Montreal (0.4%) and Halifax (0.3%).

All five constituent markets in Western Canada have now joined the downtrend. For Calgary it was the eighth consecutive month without a rise, a cumulative decline of 3.2%, for Vancouver the seventh (a cumulative −3.9%), for Edmonton the sixth (−3.5%) and for Victoria the fifth (−2.5%). The index for Winnipeg has risen only once in the last five months (cumulative −1.9%). In central Canada, Hamilton has gone five months without a rise (cumulative −2.3%) and Ottawa-Gatineau has risen in only one of the last five months (cumulative −0.8%). The index for Montreal, in striking contrast, has declined only once in the last 11 months (cumulative gain 5.3%) and is the only constituent index that was up from six months earlier. For the composite index it was a fifth consecutive month without a rise, for a cumulative decline of 1.4%.

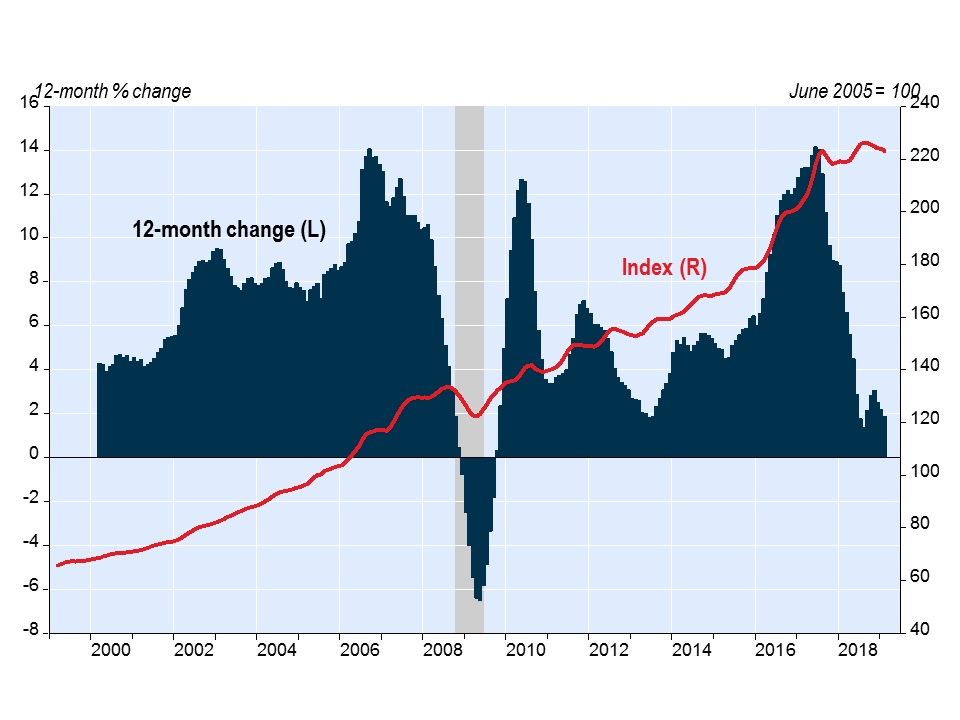

Teranet-National Bank National Composite House Price Index™

In changes from 12 months earlier, only three indexes showed the weakness that has more recently become apparent in several regions: Calgary (−2.7%), Edmonton (−1.6%) and Vancouver (−1.1%). The change from a year earlier remained positive for Halifax (1.2%), Winnipeg (1.3%), Victoria (2.8%), Hamilton (3.0%), Quebec City (3.5%), Toronto (3.6%), Montreal (5.2%) and Ottawa-Gatineau (6.0%). The composite index was up 1.9% from a year earlier.

Besides the Toronto and Hamilton indexes included in the composite index, indexes exist for the seven other urban areas of the Golden Horseshoe. In February, they were down from the previous month for Kitchener (−1.3%), St. Catharines (−1.0%), Oshawa (−0.5%) and Guelph (−0.3%). The index for Barrie was flat. Indexes were up for Peterborough (0.5%) and Brantford (1.5%). As with Toronto, Hamilton and Ottawa-Gatineau, none of these indexes was higher than it had been six months earlier.

Indexes not included in the composite index also exist for seven markets outside the Golden Horseshoe, five in Ontario and two in B.C. In February four of them were down from the month before: Sudbury (−3.4%), Kingston (−2.6%), Abbotsford Mission (−0.9%) and Windsor (−0.4%%). Kelowna was up 0.3%, Thunder Bay 0.3% and London 0.9%. Only two of these seven, Windsor and London, were up from six months earlier. In other words, of 25 metropolitan markets surveyed, only three – Montreal, Windsor and London – were up from six months earlier, the weakest diffusion of six-month gains for any February since the recession.

For the full report including historical data, please visit https://housepriceindex.ca/2019/03/february2019/.